Money Management Strategies 2025: Practical Tips for Mastering Your Finances and Securing Your Future

In 2025, managing your money is more important than ever. With inflation affecting purchasing power, job market uncertainties, and rising living costs, it’s easy to feel like your financial goals are slipping out of reach. But you don’t have to let these challenges control your future. In fact, the right money management strategies 2025 can turn financial uncertainty into an opportunity for growth and security.

Whether you’re struggling to save, buried under debt, or just unsure of where to start, this guide is here to help you navigate these obstacles with practical, actionable tips. We’ll break down the essential steps you can take today to master your finances, plan for the future, and secure financial freedom. The strategies outlined in this article will empower you to take control, avoid common mistakes, and build a confident, informed relationship with your money. Let’s dive in and take the first step toward a secure financial future.

Table of Contents

Toggle 1: Assessing Your Current Financial Situation

1: Assessing Your Current Financial Situation

Before you can create a plan for mastering your finances, you need to understand where you stand today. This step is crucial because knowing your current financial situation gives you the clarity needed to make informed decisions. Here’s how you can assess your finances effectively in just a few simple steps:

1. Track Your Income

Start by identifying all the sources of income you receive. This includes your salary, freelance work, investments, and any other passive income streams. List them out and calculate your total monthly income. This will help you understand how much money you have coming in each month.

2. Review Your Expenses

Next, take a close look at your monthly expenses. Break them down into two categories:

- Fixed expenses: These are regular, non-negotiable costs such as rent or mortgage payments, utilities, and insurance premiums.

- Variable expenses: These are costs that can fluctuate, like groceries, entertainment, and dining out.

Tracking these expenses helps you understand where your money is going and where you might be overspending. Use an app or spreadsheet to make this process easier!

3. Understand Your Debt

Many people have various forms of debt, from student loans to credit cards or personal loans. List all your debts, including the interest rates and repayment schedules. This will give you a clear picture of how much you owe and what you need to prioritize paying off first.

Tip: Focus on high-interest debts (like credit cards) before tackling lower-interest ones. This can save you money in the long run.

4. Evaluate Your Assets

Look at the assets you own, including savings accounts, investments, real estate, and other valuable items. Knowing the value of your assets helps you understand your net worth, which is crucial for long-term planning.

5. Check Your Credit Score

Your credit score plays a big role in your financial health. It affects your ability to get loans, credit cards, and even rent an apartment. Many free tools, such as Credit Karma, can give you a snapshot of your credit score and help you track it over time.

Why This Matters:

Taking the time to assess your current financial situation is the foundation for creating a practical financial strategy. It allows you to identify areas where you can improve, like cutting back on unnecessary spending or paying off high-interest debt. Without this insight, it’s hard to move forward with confidence.

Action Step: Set aside time this week to complete each of these steps. Once you know where you stand, you’ll be in a better position to make smarter, more informed decisions about your money in 2025.

2: Setting Clear Financial Goals for 2025

2: Setting Clear Financial Goals for 2025

Now that you understand your financial situation, it’s time to set clear, actionable goals. Without a roadmap, it’s easy to lose direction and fall back into old habits. Financial goals give you something concrete to work towards, helping you stay focused and motivated. Here’s how you can set effective financial goals for 2025:

1. Define Your Short-Term Goals

Short-term goals are those you can achieve within the next 6 to 12 months. These goals help you build momentum and confidence. Examples include:

- Building an emergency fund: Aim to save 3-6 months of expenses to cover unexpected situations (e.g., job loss or medical bills).

- Paying off high-interest debt: Focus on clearing credit card debt or payday loans to save on interest.

- Improving your credit score: A small increase in your score can lead to better interest rates and financial opportunities.

By tackling short-term goals, you create a solid foundation that allows you to focus on more significant, long-term objectives.

2. Set Long-Term Goals

Long-term goals typically take several years to achieve, but they’re key to securing your financial future. Some examples include:

- Saving for retirement: Aim to contribute consistently to your retirement account, such as a 401(k) or IRA, to build wealth for the future.

- Buying a home: Start saving for a down payment and improving your credit to secure a better mortgage rate.

- Funding education: Whether it’s for you or your children, setting aside money in a 529 plan or other savings account can help with future tuition costs.

Remember: Long-term goals need patience and discipline. Break them down into smaller milestones to keep track of your progress.

3. Use the SMART Framework

To ensure your goals are realistic and achievable, use the SMART method:

- Specific: Clearly define what you want to achieve (e.g., “Save $5,000 for an emergency fund”).

- Measurable: Make sure you can track your progress (e.g., “Save $400 per month”).

- Achievable: Set a goal that challenges you but is still possible.

- Relevant: Align your goals with your values and long-term vision.

- Time-bound: Set a deadline for when you want to achieve the goal (e.g., “Save $5,000 by the end of 2025”).

Using SMART goals helps you avoid vague ambitions and keeps you accountable.

4. Prioritize Your Goals

You may have several goals, but it’s important to prioritize them based on urgency and importance. Start with goals that provide the most immediate impact, like building an emergency fund or paying off high-interest debt. Once those are in place, focus on long-term goals such as investing or retirement planning.

Why This Matters:

Setting clear financial goals for 2025 will keep you on track, help you avoid distractions, and ensure that your efforts are working toward meaningful outcomes. Without specific goals, it’s easy to lose sight of your financial priorities and waste time on less important tasks.

Action Step: Take some time today to write down your financial goals for 2025. Use the SMART framework to make them actionable and realistic. Once your goals are defined, you’ll have a clear roadmap to follow and a better sense of direction in your financial journey.

3: Creating a Budget That Works

3: Creating a Budget That Works

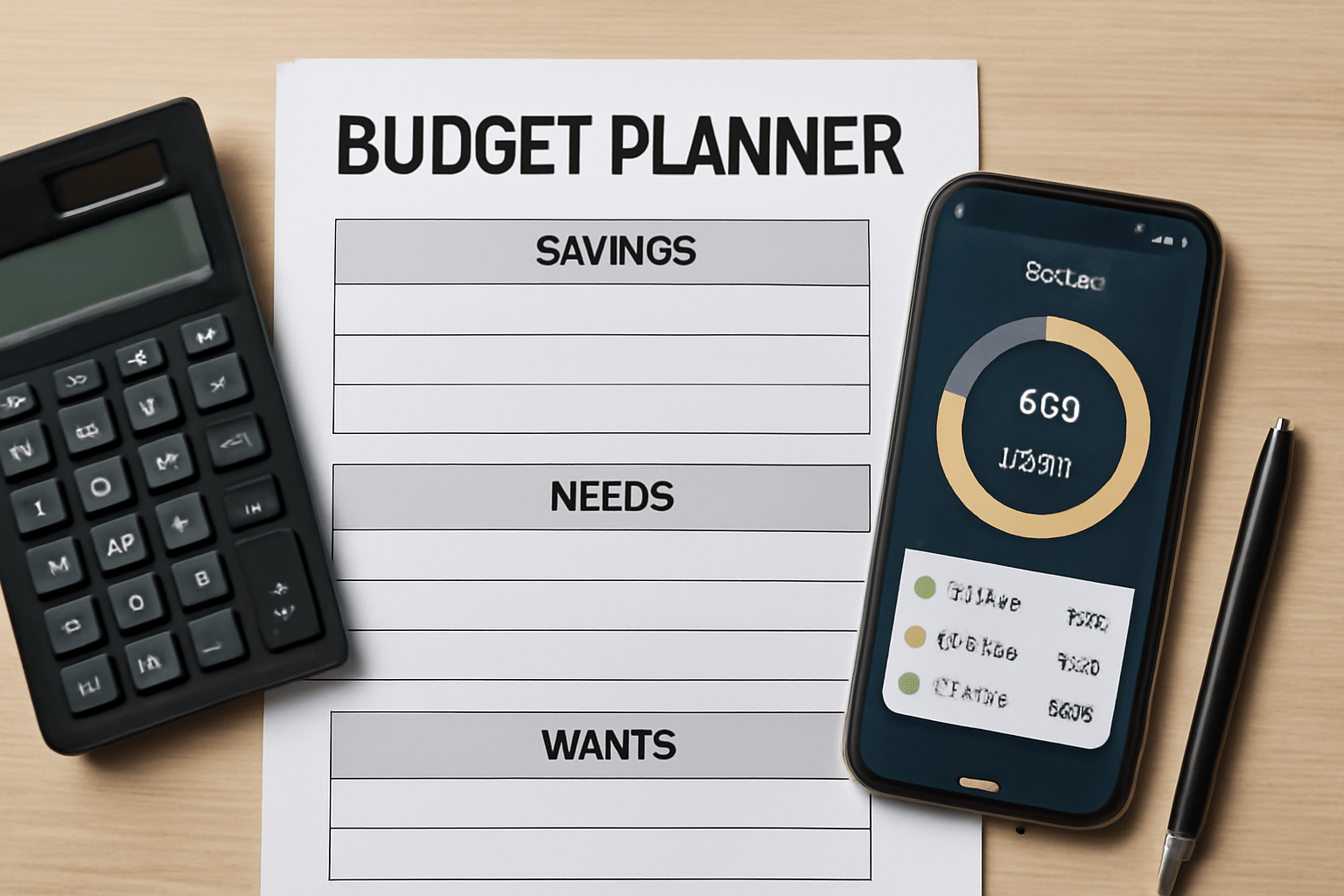

Creating a budget is one of the most effective ways to take control of your finances. It allows you to track where your money is going, reduce unnecessary expenses, and ensure you’re saving for your goals. In 2025, having a well-organized budget can be the difference between financial stress and financial freedom. Here’s how to create a budget that works for you:

1. Understand Your Income and Expenses

Before you can create a budget, you need a clear picture of your income and expenses.

- Income: Include all sources—salary, freelance work, side gigs, and passive income. Be realistic about what you bring home after taxes.

- Expenses: Break them into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment). Track them for at least a month to understand your spending habits.

Tip: Use budgeting tools or apps like Mint or YNAB (You Need A Budget) to track your expenses automatically. This makes the process faster and more accurate.

2. Choose a Budgeting Method

Once you have a clear understanding of your finances, it’s time to choose a budgeting method. The most popular methods are:

- Zero-Based Budget: Every dollar of your income is assigned a specific purpose—spending, saving, or investing. This method forces you to be intentional with every dollar you earn.

- 50/30/20 Rule: This simple approach divides your income into three categories:

- 50% for needs (rent, utilities, food),

- 30% for wants (entertainment, dining out),

- 20% for savings (retirement, emergency fund).

Tip: If you’re new to budgeting, the 50/30/20 rule is a great starting point. It’s flexible and easy to follow.

3. Set Realistic Limits

Once you’ve categorized your expenses, it’s time to set limits. Make sure your budget is realistic, not overly restrictive. For example, if you love dining out, allocate a reasonable amount for that category. If you want to save more, find areas where you can cut back, like subscription services or unnecessary shopping.

Tip: Review your budget regularly to adjust based on changes in income or lifestyle. Life isn’t static, and your budget should reflect that.

4. Automate Your Savings

One of the easiest ways to stick to your budget is to automate your savings. Set up automatic transfers to your savings or investment accounts as soon as you get paid. Treat this like a non-negotiable expense.

Tip: Automate bill payments and savings to avoid late fees and ensure you consistently meet your financial goals.

5. Track and Adjust Regularly

A budget isn’t something you set and forget. Regularly track your spending and adjust your budget as needed. Use budgeting apps to monitor your progress or review your spending every week to ensure you’re on track.

Tip: If you’re overspending in one category, make adjustments in others to stay balanced.

Why This Matters:

A well-structured budget helps you control your finances, avoid debt, and ensure that you’re saving for the future. Without a clear plan for how to allocate your money, it’s easy to get overwhelmed or fall off track. A budget provides clarity, discipline, and peace of mind as you work toward your financial goals.

Action Step: Set aside some time this week to create or refine your budget. Start with the 50/30/20 rule if you’re a beginner, and make sure to automate your savings. Tracking your expenses will soon become second nature, and you’ll see the results in your financial stability.

4: Building an Emergency Fund

4: Building an Emergency Fund

An emergency fund is a crucial part of any solid financial strategy. It acts as a financial safety net, helping you avoid going into debt when unexpected expenses arise. Whether it’s a medical emergency, car repair, or sudden job loss, having a dedicated savings buffer ensures you’re prepared for life’s curveballs. Here’s how you can build an emergency fund that works for you:

1. Start with a Small Goal

You don’t need to save a huge amount right away. Start small—aim for an initial goal of $500 to $1,000. This amount can cover most minor emergencies like unexpected car repairs or a medical bill. Once you hit this target, you can start building it further.

Tip: Focus on your first milestone and resist the temptation to dip into the fund for non-emergencies.

2. Set a Realistic Savings Plan

Determine how much you can comfortably save each month. Look at your budget to see if you can allocate a portion of your income towards this fund. Even $50 to $100 a month can add up quickly. The key is consistency.

Tip: Consider automating your savings. Set up a recurring transfer from your checking account to a separate savings account, so you never forget or spend the money.

3. Increase Savings with Windfalls

Take advantage of extra income like tax refunds, work bonuses, or side job earnings. Instead of spending these windfalls, deposit them directly into your emergency fund. This can fast-track your savings and get you closer to your target faster.

Tip: Treat unexpected income as “bonus savings” rather than extra spending money.

4. Cut Back on Discretionary Spending

If you’re struggling to build your emergency fund, look for areas to reduce discretionary spending. Small adjustments like cutting down on dining out, subscription services, or impulse shopping can free up more money for your fund.

Tip: Find one or two things you can cut back on each month, even if it’s just temporarily. The less you spend, the faster you can grow your fund.

5. Keep the Fund Accessible but Separate

Your emergency fund should be easy to access in a real emergency, but not so easy that you’re tempted to use it for non-urgent purchases. A high-yield savings account is a great option—it keeps your money accessible, but the interest helps it grow over time.

Why This Matters:

Having an emergency fund is one of the simplest yet most powerful ways to protect yourself from financial stress. It gives you peace of mind, reduces the risk of falling into debt during tough times, and sets you up for financial stability in 2025 and beyond.

Action Step: Set a realistic goal to save your first $500 to $1,000 for emergencies. Automate your savings, cut back on unnecessary expenses, and watch your fund grow. Once you reach your initial target, aim for 3-6 months’ worth of living expenses to give yourself even more security.

5: Debt Management Strategies

5: Debt Management Strategies

Managing debt is one of the most important steps in securing your financial future. High-interest debt can quickly spiral out of control, but with the right strategy, you can take back control of your finances and work toward becoming debt-free. Here’s how to manage and reduce your debt effectively in 2025:

1. Understand Your Debt Situation

Start by listing all your debts: credit cards, student loans, personal loans, mortgages, etc. Note the balance, interest rate, and minimum payment for each. This helps you prioritize which debts to pay off first.

Tip: Using a simple spreadsheet or app to track your debts makes it easier to see the big picture and avoid missing any payments.

2. Choose the Right Debt Repayment Strategy

There are two main strategies to pay down debt:

- Debt Avalanche Method: Pay off the debt with the highest interest rate first, while making minimum payments on others. This method saves you the most money in interest over time.

- Debt Snowball Method: Pay off the smallest debt first, while making minimum payments on others. Once the smallest debt is paid off, move to the next smallest. This approach builds momentum and motivation.

Tip: If you’re motivated by quick wins, the debt snowball method might work better for you. If you want to save on interest, the debt avalanche method is ideal.

3. Consolidate or Refinance Debt

If you have multiple high-interest debts, consolidating them into one loan with a lower interest rate can simplify payments and save money. Look into personal loans or balance transfer credit cards that offer 0% APR for an introductory period.

Tip: Be cautious of fees and terms when consolidating or refinancing. Always calculate whether the savings outweigh the costs.

4. Make Extra Payments When Possible

Whenever possible, make extra payments toward your debts. Even a small extra payment can significantly reduce your principal balance, leading to less interest over time. Look for opportunities to pay extra, such as with windfalls or bonuses.

Tip: Consider making bi-weekly payments instead of monthly ones. This results in one extra payment per year, which can help pay down debt faster.

5. Avoid Accruing More Debt

While paying off existing debt, avoid accumulating more. This means controlling your spending, especially on high-interest items like credit cards. If you must use credit cards, try to pay off the balance in full each month to avoid interest.

Tip: Set up automatic bill payments to avoid late fees and missed payments, which can lead to even higher debt.

6. Seek Professional Help If Needed

If your debt feels overwhelming, don’t hesitate to seek help. A financial advisor or credit counselor can assist in creating a debt management plan tailored to your situation. Some nonprofits offer free or low-cost counseling services.

Why This Matters:

Proper debt management frees up your money, reduces stress, and accelerates your progress toward financial goals. The sooner you take action, the quicker you can pay off your debt and start building wealth.

Action Step: Review your debt today, choose a repayment strategy, and take your first step toward becoming debt-free. Whether you’re tackling high-interest credit cards or student loans, starting today puts you one step closer to financial freedom.

6: Smart Investing in 2025

6: Smart Investing in 2025

Investing is one of the most powerful ways to grow your wealth, especially as you work toward securing your financial future. But with the fast-paced changes in the financial markets, how do you ensure you’re making smart investment decisions in 2025? Here’s how you can navigate the world of investing with confidence:

1. Start Early and Invest Consistently

The earlier you start investing, the more time your money has to grow. Even small, regular contributions to your investments can accumulate over time. The key is consistency. Whether you’re contributing to a retirement account or building a brokerage account, aim to invest regularly, even if it’s just a small amount each month.

Tip: Automate your investments through features like employer 401(k) contributions or set up monthly deposits into an investment account to ensure you stay consistent.

2. Diversify Your Portfolio

A diversified portfolio spreads your investments across various asset classes—stocks, bonds, real estate, and more. This reduces risk by ensuring that if one area of the market underperforms, others may perform better.

- Stocks: Great for long-term growth but come with higher volatility.

- Bonds: Provide steady income with lower risk but less growth potential.

- Real Estate: Real estate investments can offer diversification and long-term growth potential.

Tip: Consider using low-cost index funds or ETFs that offer exposure to a broad range of assets, which is an easy way to diversify.

3. Understand Your Risk Tolerance

Before you invest, assess your risk tolerance. This is how much risk you’re willing to take in exchange for potential returns. If you’re younger and investing for long-term goals like retirement, you may have a higher tolerance for risk and can afford to invest in more volatile assets, like stocks. If you’re closer to a financial goal or retirement, you might want to take a more conservative approach with bonds or dividend-paying stocks.

Tip: Use online risk tolerance quizzes to assess your comfort level with risk before building your portfolio.

4. Take Advantage of Tax-Advantaged Accounts

Tax-advantaged accounts, like IRAs, 401(k)s, and HSAs, allow your money to grow tax-free or tax-deferred, meaning you’ll pay fewer taxes on your investment returns. This can help you keep more of your earnings, boosting your long-term growth.

Tip: Contribute enough to your 401(k) to receive any employer match—this is essentially free money for your retirement.

5. Consider Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps to reduce the impact of market volatility, as you buy more shares when prices are low and fewer when prices are high. Over time, this can help you avoid the stress of trying to time the market.

Tip: Automate your monthly investment contributions to take advantage of dollar-cost averaging.

6. Stay Focused on Long-Term Goals

Investing is not about quick wins or market timing. It’s about building wealth over time. Resist the temptation to react to short-term market fluctuations. Instead, stay focused on your long-term financial goals, whether that’s retirement, a down payment on a home, or funding education.

Tip: Review your investments periodically, but avoid checking your portfolio daily. Long-term success comes from staying the course.

Why This Matters:

Smart investing is the key to growing your wealth, achieving financial independence, and securing your future. By starting early, diversifying your investments, and maintaining a long-term focus, you’ll be well on your way to mastering your finances in 2025 and beyond.

Action Step: Start today by setting up an automated investment plan, choosing low-cost index funds, and contributing regularly to tax-advantaged accounts. The earlier you start, the more time your investments have to grow!

7: Retirement Planning for the Future

7: Retirement Planning for the Future

Planning for retirement is one of the most important financial steps you can take. The earlier you start, the more comfortable your retirement years will be. Whether you’re in your 20s, 30s, or closer to retirement, it’s never too early—or too late—to begin. Here’s how to plan for a secure retirement in 2025:

1. Start Contributing to Retirement Accounts Early

The key to a successful retirement is starting early. The earlier you contribute to retirement accounts like a 401(k), IRA, or Roth IRA, the more time your money has to grow. Even small contributions can add up over time thanks to compound interest.

Tip: If your employer offers a 401(k) match, contribute enough to take full advantage of the match—this is essentially free money.

2. Choose the Right Type of Retirement Account

There are several retirement account options, each with its own benefits. Choosing the right one depends on your goals and tax situation:

- 401(k): Great for those with employer-sponsored plans. Contributions are tax-deferred, meaning you pay taxes when you withdraw the funds in retirement.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals are tax-free in retirement, which is ideal if you expect to be in a higher tax bracket in the future.

- Traditional IRA: Similar to a 401(k), contributions are tax-deferred, but there are income limits for tax-deductible contributions.

Tip: If possible, contribute to both a 401(k) and a Roth IRA to diversify your tax benefits.

3. Estimate How Much You’ll Need in Retirement

Start by estimating how much money you’ll need each year during retirement. A common rule of thumb is to aim for 70-80% of your pre-retirement income annually. However, this number may vary depending on your lifestyle and any additional sources of income (like pensions or Social Security).

Tip: Use online retirement calculators to estimate how much you need to save each month to reach your retirement goals.

4. Aim for 15-20% of Your Income for Retirement

Financial experts recommend saving 15-20% of your annual income for retirement. If you can’t save this much right away, start with a smaller percentage and gradually increase it over time as your income grows.

Tip: If you’re behind on retirement savings, consider making catch-up contributions once you reach 50, which allows you to contribute more to retirement accounts.

5. Monitor and Adjust Your Plan Regularly

Your retirement plan should be flexible. As your life circumstances change—such as a job change, raise, or life event—your retirement savings strategy should evolve as well. Periodically review your investments and savings rate to stay on track.

Tip: Schedule a yearly check-in with a financial advisor to ensure your retirement plan is still aligned with your goals.

6. Don’t Rely Solely on Social Security

Social Security can be a helpful supplement in retirement, but it’s unlikely to be enough to cover all your expenses. Consider it as a bonus rather than the primary source of your retirement income.

Tip: Focus on building your personal retirement savings to ensure you’re financially independent in your later years.

Why This Matters:

The earlier you start planning for retirement, the more time you have to grow your wealth and reach your retirement goals. With a clear strategy, consistent saving, and the right accounts, you can create a secure financial future for yourself.

Action Step: Start contributing to a retirement account today. Set a realistic goal based on your needs and adjust it regularly. The earlier you begin, the easier it will be to achieve a comfortable retirement.

8: Leveraging Technology for Money Management

8: Leveraging Technology for Money Management

In 2025, technology plays a crucial role in simplifying and improving money management. From budgeting apps to AI-driven financial tools, there are countless resources available to help you track your spending, save efficiently, and make smarter investment decisions. Here’s how you can use technology to your advantage:

1. Use Budgeting Apps to Track Expenses

Budgeting apps like Mint, YNAB (You Need a Budget), and PocketGuard make it easy to see where your money is going. These apps automatically categorize your expenses, alert you when bills are due, and help you stick to your budget. They provide real-time insights into your spending habits, which can help you make smarter decisions.

Tip: Set up spending alerts so you know when you’re approaching your budget limits. This can prevent overspending and keep your finances in check.

2. Automate Savings and Bill Payments

One of the best ways to stick to your financial goals is to automate your savings and bill payments. Set up automatic transfers to your savings or investment accounts so you pay yourself first. Use tools like Chime or Simple that round up your purchases and save the change, building your savings passively.

Tip: Automating payments for bills like utilities or subscriptions ensures you never miss a due date and avoid late fees.

3. Invest Using Robo-Advisors

Robo-advisors like Betterment and Wealthfront use algorithms to manage your investments based on your risk tolerance and financial goals. These platforms offer low fees and are ideal for beginners who want to invest but don’t have the time or expertise to manage their portfolios.

Tip: Start with a robo-advisor if you’re new to investing. They’re a low-cost, low-maintenance way to build a diversified portfolio without the hassle.

4. Track Your Credit Score with Apps

Your credit score affects your ability to borrow money and the interest rates you receive. Apps like Credit Karma and Experian offer free credit score tracking and provide insights into ways to improve your score. These apps also alert you to any changes in your credit report, so you can take action quickly if needed.

Tip: Check your credit score regularly and work on improving it by paying down debt and ensuring your credit report is accurate.

5. Use AI to Optimize Spending and Investments

AI-driven tools are revolutionizing money management. Apps like Cleo and Albert use artificial intelligence to analyze your spending habits and provide tailored advice on saving and investing. They can also offer automatic savings suggestions and help you optimize your financial strategies.

Tip: Use AI-powered tools to provide personalized recommendations, automate savings, and receive financial advice tailored to your habits and goals.

6. Secure Your Finances with Digital Tools

Digital wallets like Apple Pay, Google Wallet, and Venmo allow you to make secure payments without carrying physical cash or cards. For added security, use tools like LastPass or 1Password to manage your passwords and keep your financial accounts secure.

Tip: Use two-factor authentication for any financial accounts and consider setting up alerts for any large or suspicious transactions.

Why This Matters:

Technology streamlines money management, making it easier to save, invest, and track your progress toward financial goals. By leveraging these tools, you can reduce the time spent managing your finances while improving your financial outcomes.

Action Step: Start by downloading a budgeting app, setting up automated savings, and exploring robo-advisors for your investments. Technology is here to simplify the process—use it to your advantage!

9: Tax Planning and Maximizing Deductions

9: Tax Planning and Maximizing Deductions

Effective tax planning is an essential part of your overall money management strategy. By understanding how taxes work and utilizing available deductions, you can keep more of your hard-earned money and reduce your taxable income. Here’s how to optimize your tax situation in 2025:

1. Maximize Contributions to Tax-Advantaged Accounts

One of the best ways to reduce your taxable income is by contributing to tax-advantaged accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs). These contributions are either tax-deferred (you pay taxes when you withdraw the funds) or tax-free (like with a Roth IRA). This strategy not only lowers your current tax bill but also helps you build wealth for the future.

Tip: Contribute the maximum allowable amount to your retirement accounts, especially if your employer offers a 401(k) match. This is essentially “free” money for your retirement!

2. Take Advantage of Tax Deductions

Tax deductions can significantly reduce your taxable income. Common deductions include:

- Student Loan Interest: You can deduct up to $2,500 in student loan interest, depending on your income.

- Mortgage Interest: Homeowners can deduct mortgage interest on up to $750,000 of loan debt.

- Charitable Contributions: Donations to qualifying charities are deductible, whether made in cash or as non-cash items.

- Medical Expenses: If your medical expenses exceed 7.5% of your adjusted gross income (AGI), you can deduct the amount above that threshold.

Tip: Keep detailed records of deductions you qualify for, especially if you make significant charitable donations or have high medical costs.

3. Use Tax Credits to Reduce Your Tax Bill

Unlike deductions, which reduce your taxable income, tax credits directly reduce your tax liability. Some valuable tax credits include:

- Earned Income Tax Credit (EITC): A credit for low-to-moderate-income earners.

- Child Tax Credit: Provides up to $2,000 per qualifying child.

- Education Credits: The American Opportunity Credit and Lifetime Learning Credit can help offset the cost of education.

Tip: Review eligibility for tax credits each year. Many credits are based on your income, filing status, and number of dependents, so make sure you’re taking full advantage.

4. Track Your Business Expenses

If you’re self-employed or have a side hustle, you can deduct many business-related expenses. This includes things like office supplies, travel expenses, home office deductions, and software costs. Keeping meticulous records of these expenses is crucial for maximizing your tax savings.

Tip: Use accounting software like QuickBooks or FreshBooks to track your business expenses throughout the year, making tax season much easier.

5. Consider Tax Loss Harvesting

If you invest in taxable accounts, tax loss harvesting can help offset gains by selling investments that have lost value. The losses can be used to reduce your taxable income, lowering your tax bill.

Tip: Consult a tax advisor to determine if tax loss harvesting makes sense for your investment strategy. It can be particularly useful for investors with high capital gains.

6. Plan for Estimated Taxes (if Applicable)

If you’re self-employed or have income that isn’t subject to automatic withholding (such as freelance income), you may need to pay estimated quarterly taxes. Be sure to set aside money throughout the year for these payments to avoid penalties.

Tip: Use an online tax calculator or work with an accountant to estimate your quarterly payments. It’s better to make small, consistent payments than to be hit with a large tax bill at the end of the year.

Why This Matters:

Proper tax planning allows you to reduce your taxable income and potentially increase your refund. By taking advantage of deductions, credits, and tax-advantaged accounts, you can keep more money in your pocket, which can be redirected toward saving, investing, or paying down debt.

Action Step: Start gathering your tax documents early in the year, and consider working with a tax professional to ensure you’re maximizing all available deductions and credits. Keep an eye on tax law changes in 2025 to make sure you’re staying up-to-date.

10: Building Wealth and Protecting Your Assets

10: Building Wealth and Protecting Your Assets

Building wealth isn’t just about earning more money—it’s about making smart choices that allow your money to grow over time. Protecting your assets ensures that your hard-earned wealth is secure from risks like theft, lawsuits, or unforeseen disasters. Here’s how to effectively build and protect your wealth in 2025:

1. Invest for Long-Term Growth

The foundation of wealth-building is consistent, long-term investing. Focus on assets that have the potential for growth, such as:

- Stocks and Bonds: Stocks are great for growth, while bonds offer stability and income.

- Real Estate: Property can provide both appreciation and passive rental income.

- Alternative Investments: Explore options like peer-to-peer lending, commodities, or startups.

Tip: Diversify your investments across different asset classes to reduce risk and increase your chances of steady growth.

2. Automate Your Investments

Make investing a regular habit by automating your contributions. This way, you invest consistently without having to think about it. Set up automatic transfers to retirement accounts, brokerage accounts, or other investment vehicles each month.

Tip: Automating your investments can take advantage of dollar-cost averaging, which reduces the impact of market volatility and allows you to invest regularly regardless of market conditions.

3. Create an Estate Plan

Estate planning ensures that your wealth is passed on to the right people and protects your loved ones in case of unexpected events. It includes creating:

- Wills: Clearly state how your assets will be distributed.

- Trusts: These can help minimize estate taxes and ensure your wishes are followed.

- Power of Attorney: Appoint someone to make decisions if you become incapacitated.

Tip: Even if you’re young, having a basic estate plan in place can provide peace of mind and help your family avoid legal complications.

4. Protect Your Wealth with Insurance

Insurance is key to protecting your wealth from unexpected events. Ensure you have the right coverage for your needs:

- Life Insurance: Protect your family if something happens to you.

- Homeowners or Renters Insurance: Covers your home and personal property.

- Disability Insurance: Replaces income if you can’t work due to illness or injury.

Tip: Regularly review your insurance policies to make sure you have adequate coverage, especially if your assets or family situation changes.

5. Build a Strong Credit Profile

Your credit score plays a huge role in wealth-building. A good credit score can save you money by giving you access to lower-interest rates on loans, mortgages, and credit cards. Regularly monitor your credit report and address any issues that could lower your score.

Tip: Pay off debt on time, keep your credit card balances low, and limit new credit inquiries to maintain a healthy credit score.

6. Minimize Debt and Avoid High-Interest Loans

Carrying high-interest debt can quickly drain your wealth. Prioritize paying off high-interest debts (like credit cards) and avoid accumulating new debt unless necessary. The less you pay in interest, the more you can invest and grow your wealth.

Tip: Focus on paying off one debt at a time using either the debt avalanche or snowball method, and avoid taking on new debt that isn’t aligned with your long-term goals.

Why This Matters:

Building wealth is a gradual process that requires disciplined saving, smart investing, and protecting your assets. Without the right strategies in place, your wealth can be eroded by risks or poor financial choices. By investing for the long-term, securing your assets, and minimizing unnecessary expenses, you set yourself up for lasting financial success.

Action Step: Take the time today to assess your investments, review your insurance coverage, and begin creating an estate plan. Protecting your wealth today ensures a more secure financial future.

Your Path to Financial Security in 2025

Mastering your finances isn’t about perfection—it’s about making consistent, informed decisions that set you up for long-term success. By following the money management strategies outlined in this guide, you can take control of your financial future, reduce stress, and work toward your goals with confidence.

From assessing your current situation and setting clear financial goals to leveraging technology and planning for retirement, each step you take brings you closer to financial freedom. Remember, it’s never too early or too late to start—every small action compounds over time, creating a solid foundation for the future.

As you move forward, stay focused on your goals, continue educating yourself, and adapt your strategies as needed. Your financial journey is unique, but with the right mindset and tools, you can build a secure and prosperous future. Start today, and let 2025 be the year you truly master your finances.

Frequently Asked Questions (FAQs)

1. What are the best money management strategies for beginners in 2025?

The best strategies for beginners include creating a budget using the 50/30/20 rule, building an emergency fund, and setting clear financial goals. Start by tracking your income and expenses, then gradually work on saving and investing. Consistency and small steps will lead to long-term financial success.

2. How do I start saving money effectively in 2025?

Start by setting a savings goal and automating your contributions. Open a high-yield savings account and aim to save at least 20% of your monthly income. Cutting back on discretionary spending, such as dining out or subscriptions, can also boost your savings.

3. What is the best way to pay off debt in 2025?

The best approach to paying off debt is using either the debt avalanche or snowball method. The avalanche method prioritizes paying off high-interest debt first, while the snowball method focuses on paying off the smallest debts for quick wins. Choose the method that fits your motivation style.

4. How can I plan for retirement in 2025 if I’m starting late?

If you’re starting late, focus on contributing as much as possible to retirement accounts like a 401(k) or IRA. Aim to save 15-20% of your income, and consider catching up with additional contributions allowed after age 50. Automating savings and adjusting your spending can help you stay on track.

5. What are the top financial apps to use in 2025?

Top financial apps include Mint for budgeting, YNAB for expense tracking, Acorns for micro-investing, and Robinhood for low-cost investing. These apps make managing your money easier by tracking expenses, automating savings, and helping you invest consistently.

6. How much should I save for an emergency fund in 2025?

Aim to save 3-6 months’ worth of living expenses in an emergency fund. This buffer will protect you from unexpected financial setbacks, such as job loss or medical emergencies. Start small, and gradually increase your fund over time.

7. How can I build wealth in 2025 with limited income?

To build wealth on a limited income, focus on increasing your savings rate, automating your investments, and reducing high-interest debt. Look for ways to increase income, like freelancing or side gigs, and invest consistently in low-cost index funds or ETFs to grow your wealth over time.

8. What is the most important financial goal to focus on in 2025?

The most important financial goal to focus on is building an emergency fund. This foundation ensures you can weather unexpected expenses without going into debt. Once that’s in place, you can focus on paying off debt, saving for retirement, and investing for the future.