All Personal Budgeting Tips

Take control of your finances with expert personal budgeting tips from Master Your Money Plan. Whether you’re just starting or refining your budget strategy, we offer practical advice to help you track expenses, cut unnecessary costs, manage debt, and grow your savings. Learn about zero-based budgeting, the 50/30/20 rule, envelope budgeting, and more to find the best method for your lifestyle. Our step-by-step guides make budgeting easy, helping you achieve financial stability and long-term success. Start making smart money moves today with our trusted budgeting insights!

All Personal Budgeting Tips Related Post

The Importance of Financial Literacy: How Mastering Money Management Can Transform Your Life

Best Practices for Money Management: Essential Tips to Secure Your Financial Future

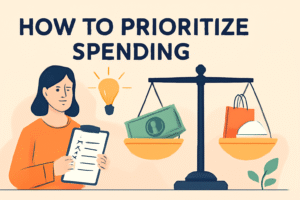

How to Prioritize Spending: A Practical Guide to Managing Your Finances Effectively

10 Money Management Tips for Students to Master Finances and Save Big

How to Manage Monthly Expenses: Practical Tips for Staying Financially Healthy and Stress-Free

Understanding Cash Flow Management: Key Strategies for Small Business Success and Financial Stability

How to Manage Personal Finances: Practical Tips for Achieving Financial Stability and Success

10 Simple Money Management Tips to Improve Your Financial Health Today

10 Realistic Budgeting Tips to Take Control of Your Finances in 2025

Emergency Expense Planning: Essential Tips for Weathering Life’s Financial Storms

Financial Planning for Events: A Step-by-Step Approach to Ensuring Success

Budget Planning for Holidays: Expert Tips for a Fun and Affordable Celebration

How to Organize Personal Finances in 2025: Expert Tips for Better Money Management

How Budget Templates for Excel Can Help You Save More and Spend Smarter

Weekly Financial Planning Tips to Stay on Track and Achieve Your Goals

Budget Plan for Single Income: Step-by-Step Strategies for Financial Stability

“Budgeting Goals for Families: Practical Strategies to Improve Your Financial Health”

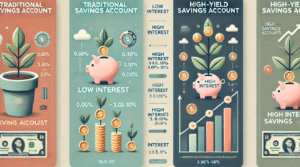

How High-Yield Savings Account Benefits Can Transform Your Financial Future

Top Personal Finance Tools for Families to Master Budgeting and Saving

Best Apps for Financial Planning to Use in 2025

How to Use Excel for Budgeting: A Simple Step-by-Step Guide

Digital Tools for Saving Money: Top Apps and Platforms to Try

Financial Software for Beginners: A Step-by-Step Guide to Managing Your Finances

10 Simple Frugal Habits to Save Money and Build Wealth Effortlessly

Discover the Best Frugal Living Blogs of 2025 to Save Money and Simplify Your Life

Frugal Living Hacks for Beginners: Your Ultimate Guide to Saving More and Spending Less

How to Choose the Right Budgeting Tool: A Complete Guide for Financial Success

How to Live Frugally on a Tight Budget: Practical Tips to Save Money Every Day

The Best Savings Strategies for Beginners: A Step-by-Step Guide to Building Wealth

Essential Financial Tips for Beginners: A Step-by-Step Guide to Organizing Your Finances

Top Money Management Apps 2025: How Technology is Revolutionizing Personal Finance

Mastering Money Management Basics: A Step-by-Step Guide to Achieving Financial Control and Stability

The Importance of Budgeting: Top Benefits for Your Financial Health

Budget Hacks for Saving Money: Simple Strategies for Big Savings

How to Plan a Monthly Budget: Smart Strategies for Managing Your Money

How a Financial Planning Calendar Can Help You Achieve Your Financial Goals

Master Your Money: The Ultimate Financial Planning Worksheet for a Secure Future

Budgeting for Students 2025: How to Master Your Money and Save More This Year

Beginner-Friendly Budgeting Tips to Get You on the Path to Financial Freedom

Step-by-Step Budget Guide: How to Track, Save, and Grow Your Money

Free Budgeting Worksheets: A Step-by-Step Guide to Better Money Management

How to Make a Budget Plan: The Ultimate Guide to Financial Freedom

Start with a Clear Financial Goal

Start with a Clear Financial Goal to take control of your money and build a secure future. At Master Your Money Plan, we provide expert personal budgeting tips to help you manage expenses, reduce debt, and grow your savings. Learn effective budgeting methods like zero-based budgeting, the 50/30/20 rule, and envelope budgeting to create a plan that works for you. Whether you’re saving for a big purchase, paying off loans, or planning for financial independence, our step-by-step guides make budgeting simple and stress-free. Take the first step towards financial freedom today!

Track Your Income and Expenses

Track Your Income and Expenses to take control of your finances and build a secure future. At Master Your Money Plan, we help you understand where your money goes, so you can make informed financial decisions. Learn effective budgeting techniques like the 50/30/20 rule, zero-based budgeting, and envelope budgeting to manage your spending wisely. By monitoring your earnings and expenses, you can identify savings opportunities, cut unnecessary costs, and achieve your financial goals faster. Start tracking today and take the first step toward financial freedom!

Financial Planning for the Future

Financial planning is the foundation of long-term security and success. It involves setting clear financial goals, managing income and expenses, saving for emergencies, investing wisely, and preparing for retirement. A well-structured plan helps you reduce financial stress, grow your wealth, and ensure stability for the future. By making informed decisions today, you can achieve financial independence and safeguard your future against uncertainties. Whether you’re starting your journey or refining your strategy, Master Your Money Plan provides expert insights and practical tips to help you stay on track. Start planning now for a financially secure tomorrow!